Introduction to mhpfilter

Muhammad Yaseen

School of Mathematical and Statistical Sciences, Clemson Universitymyaseen208@gmail.com

Javed Iqbal

State Bank of PakistanJaved.iqbal6@sbp.org.pk

M. Nadim Hanif

State Bank of PakistanNadeem.hanif@sbp.org.pk

2026-02-13

Source:vignettes/introduction.Rmd

introduction.RmdOverview

The mhpfilter package provides a fast, efficient

implementation of the Modified Hodrick-Prescott (HP)

filter for decomposing time series into trend and cyclical

components. The key innovation is automatic optimal

selection of the smoothing parameter λ using generalized

cross-validation (GCV), based on the methodology of Choudhary, Hanif

& Iqbal (2014).

Why Modified HP Filter?

The standard HP filter uses fixed λ values:

- λ = 1600 for quarterly data

- λ = 100 for annual data

- λ = 14400 for monthly data

However, these values were calibrated for U.S. quarterly GDP in the 1990s. They may not be appropriate for:

- Different countries (emerging markets vs developed economies)

- Different variables (investment is more volatile than consumption)

- Different time periods (pre/post Great Moderation)

The Modified HP filter solves this by estimating the optimal λ from the data itself using the GCV criterion:

where is the estimated trend for a given , and is the number of observations.

Installation

# Install from GitHub

devtools::install_github("myaseen208/mhpfilter")Quick Start

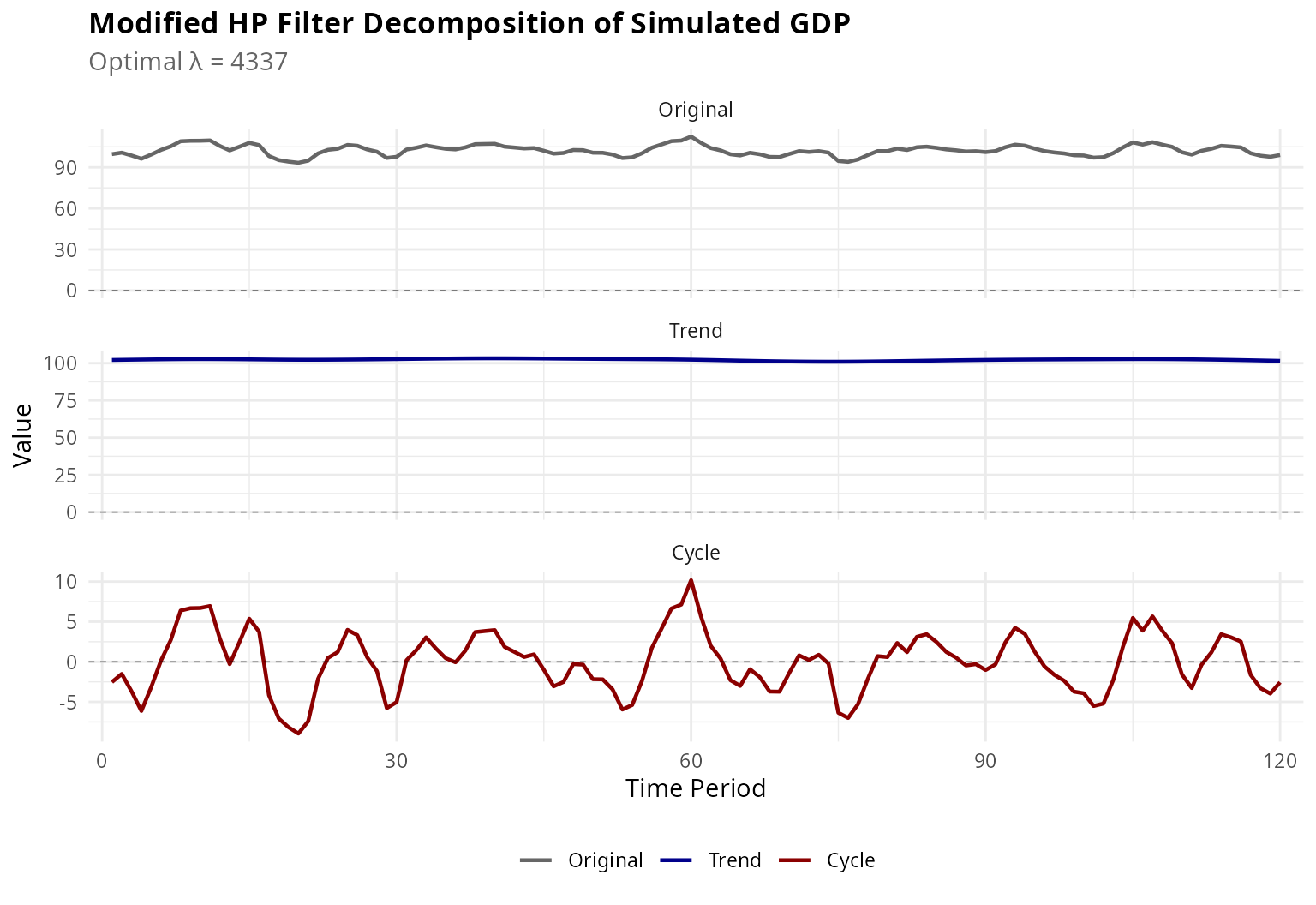

Example 1: GDP-like Series

Let’s start with a simulated series that resembles real GDP data:

set.seed(2024)

n <- 120 # 30 years of quarterly data

# Generate components

trend_growth <- 0.005 # 0.5% quarterly growth

trend <- cumsum(c(100, rnorm(n - 1, mean = trend_growth, sd = 0.002)))

# Business cycle: AR(2) process

cycle <- arima.sim(list(ar = c(1.3, -0.5)), n, sd = 2)

# Observed GDP (in logs)

gdp <- trend + cycle

# Apply Modified HP filter

result <- mhp_filter(gdp, max_lambda = 10000)

cat("Optimal lambda:", get_lambda(result), "\n")

#> Optimal lambda: 4337

cat("GCV value:", format(get_gcv(result), digits = 4), "\n")

#> GCV value: 14.36Visualization with autoplot

result_obj <- mhp_filter(gdp, max_lambda = 10000, as_dt = FALSE)

autoplot(result_obj) +

labs(

title = "Modified HP Filter Decomposition of Simulated GDP",

subtitle = paste0("Optimal λ = ", get_lambda(result_obj))

) +

theme_minimal(base_size = 11) +

theme(

plot.title = element_text(face = "bold", size = 13),

plot.subtitle = element_text(color = "gray40"),

legend.position = "bottom"

)

Figure 1: Modified HP Filter Decomposition

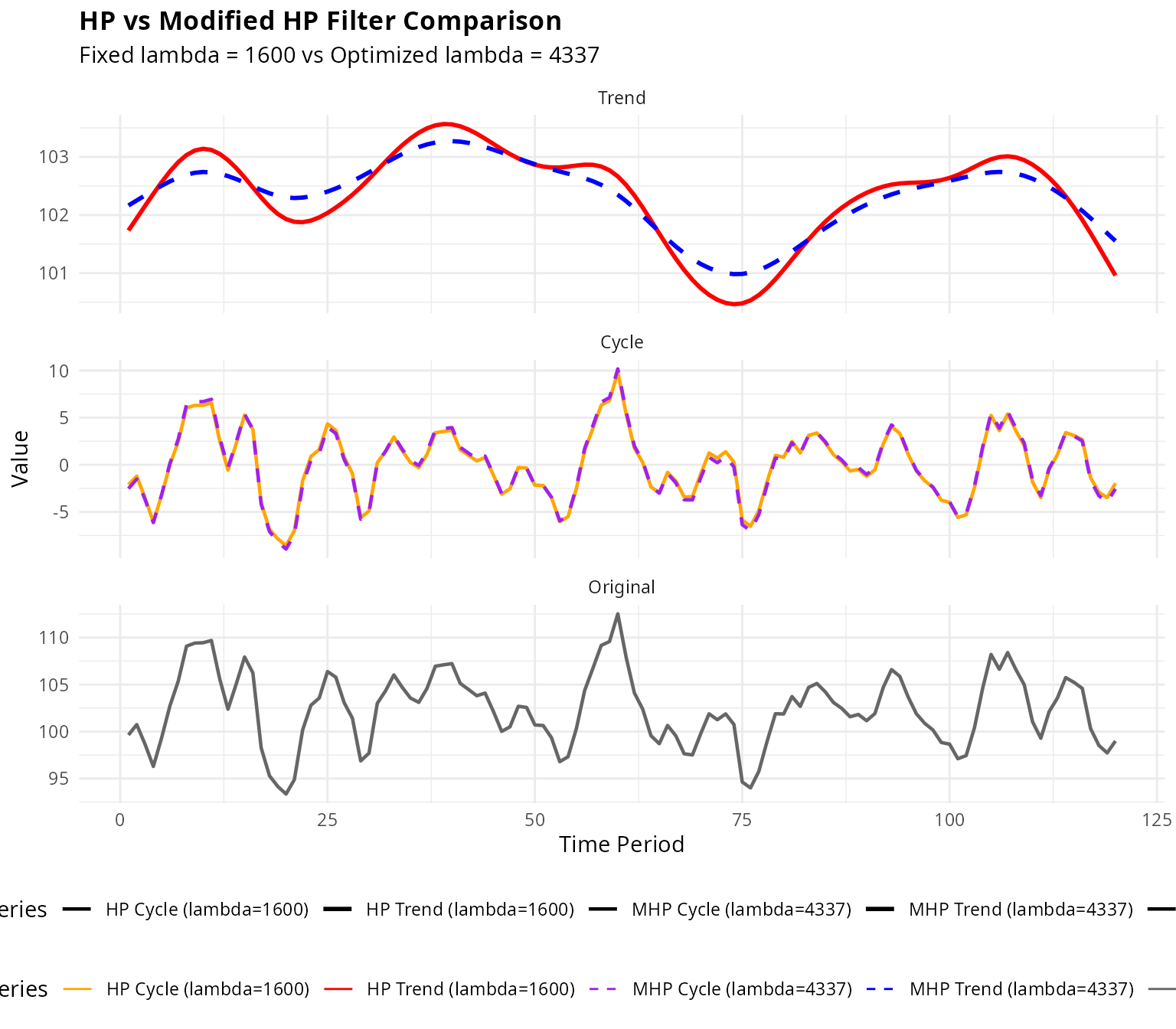

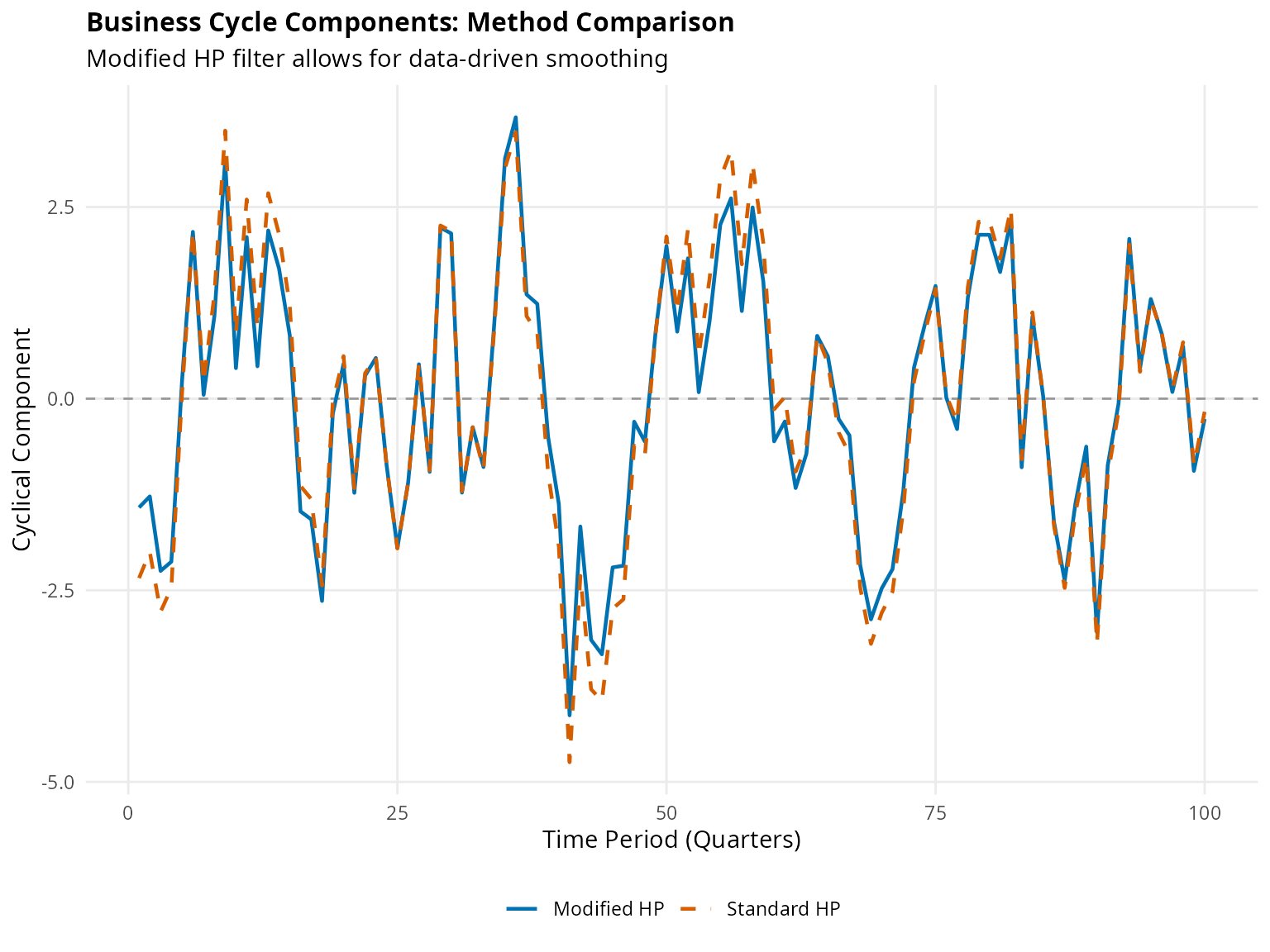

Comparison with Standard HP Filter

One of the key features of mhpfilter is the ability to

compare results with the standard HP filter:

Example 2: Why Fixed Lambda Matters

# Apply both filters

mhp_res <- mhp_filter(gdp, max_lambda = 10000)

hp_res <- hp_filter(gdp, lambda = 1600)

# Extract key statistics

comp <- mhp_compare(gdp, frequency = "quarterly", max_lambda = 10000)

print(comp)

#> method lambda cycle_sd cycle_mean ar1 cycle_range gcv

#> <char> <num> <num> <num> <num> <num> <num>

#> 1: HP 1600 3.572060 3.114072e-12 0.7922935 18.43100 NA

#> 2: Modified HP 4337 3.704804 -1.247583e-11 0.8040480 19.11926 14.36441Visual Comparison

plot_comparison(gdp, frequency = "quarterly", max_lambda = 10000, show_cycle = TRUE) +

theme_minimal(base_size = 11) +

theme(

plot.title = element_text(face = "bold", size = 13),

legend.position = "bottom",

legend.box = "vertical"

)

Figure 2: HP vs Modified HP Filter Comparison

Key Insights from Comparison

The comparison reveals important differences:

# Optimal lambda from MHP

opt_lambda <- get_lambda(mhp_res)

cat("Optimal λ (Modified HP):", opt_lambda, "\n")

#> Optimal λ (Modified HP): 4337

cat("Fixed λ (Standard HP): 1600\n\n")

#> Fixed λ (Standard HP): 1600

# Cyclical volatility

sd_mhp <- sd(mhp_res$cycle)

sd_hp <- sd(hp_res$cycle)

cat("Cycle SD (Modified HP):", round(sd_mhp, 3), "\n")

#> Cycle SD (Modified HP): 3.705

cat("Cycle SD (Standard HP):", round(sd_hp, 3), "\n")

#> Cycle SD (Standard HP): 3.572

cat("Difference:", round(sd_mhp - sd_hp, 3),

paste0("(", round(100 * (sd_mhp - sd_hp) / sd_hp, 1), "%)"), "\n")

#> Difference: 0.133 (3.7%)Batch Processing: Multi-Country Analysis

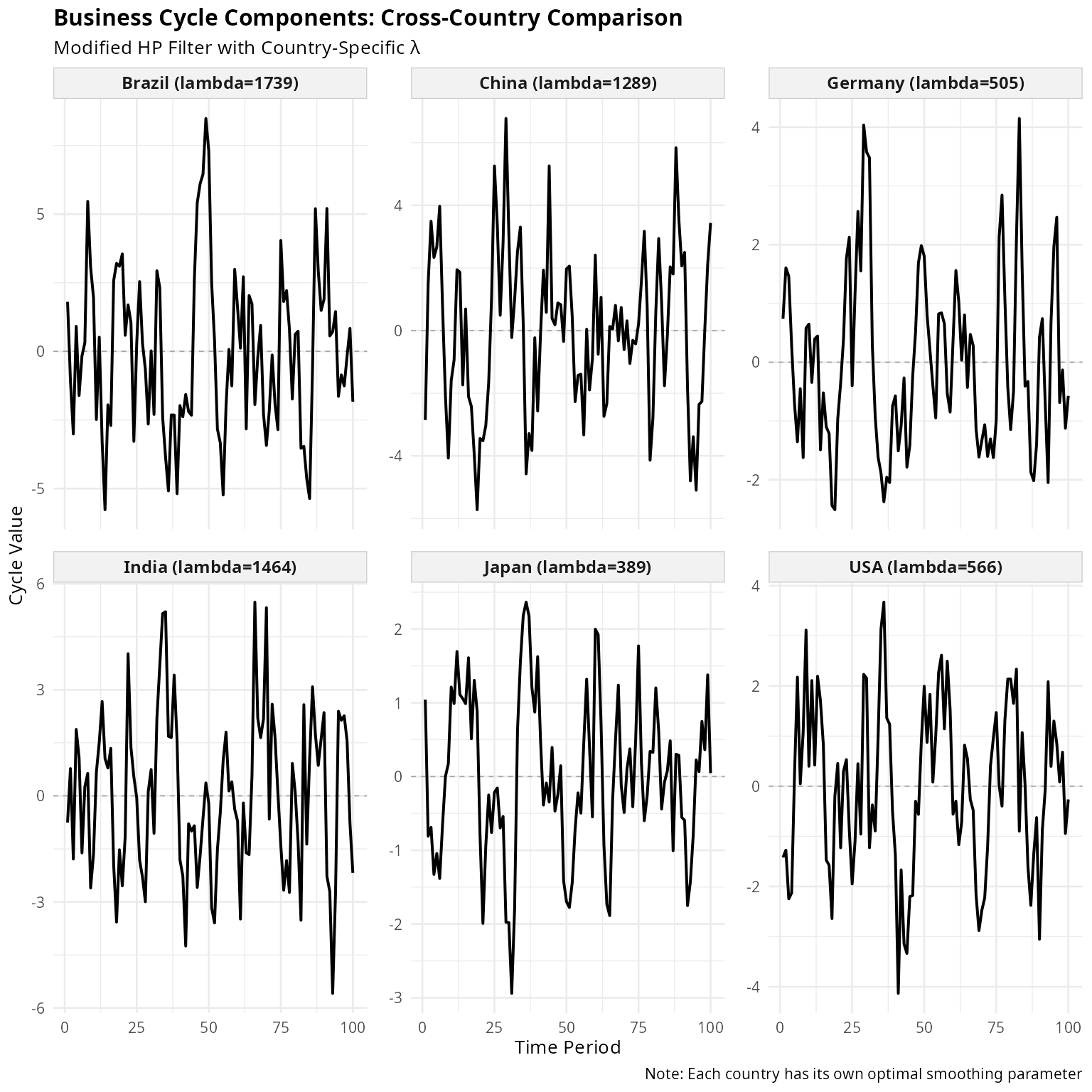

A powerful feature is batch processing multiple series simultaneously. This is particularly useful for cross-country macroeconomic comparisons.

Example 3: Cross-Country GDP Comparison

set.seed(456)

n_time <- 100 # 25 years quarterly

# Simulate GDP for multiple countries with different characteristics

countries <- c("USA", "Germany", "Japan", "China", "Brazil", "India")

characteristics <- data.table(

country = countries,

trend_growth = c(0.5, 0.4, 0.3, 1.5, 0.6, 1.2), # % quarterly

trend_vol = c(0.2, 0.15, 0.15, 0.4, 0.5, 0.6),

cycle_vol = c(1.5, 1.2, 1.0, 2.5, 3.0, 2.0),

cycle_ar = c(0.85, 0.88, 0.90, 0.75, 0.70, 0.75)

)

# Generate data

gdp_data <- sapply(1:nrow(characteristics), function(i) {

char <- characteristics[i, ]

trend <- 100 + cumsum(rnorm(n_time,

mean = char$trend_growth / 100,

sd = char$trend_vol / 100))

cycle <- arima.sim(list(ar = char$cycle_ar), n_time, sd = char$cycle_vol)

trend + cycle

})

colnames(gdp_data) <- countries

# Apply Modified HP filter to all countries

batch_result <- mhp_batch(gdp_data, max_lambda = 10000)

# View optimal lambdas

lambdas_table <- attr(batch_result, "lambdas")

print(lambdas_table)

#> series lambda gcv

#> <char> <int> <num>

#> 1: USA 566 3.647804

#> 2: Germany 505 3.096862

#> 3: Japan 389 1.812784

#> 4: China 1289 7.544833

#> 5: Brazil 1739 9.723271

#> 6: India 1464 5.676737Visualizing Cross-Country Cycles

plot_batch(batch_result, show = "cycle", facet = TRUE) +

labs(

title = "Business Cycle Components: Cross-Country Comparison",

subtitle = "Modified HP Filter with Country-Specific λ",

caption = "Note: Each country has its own optimal smoothing parameter"

) +

theme_minimal(base_size = 10) +

theme(

plot.title = element_text(face = "bold", size = 12),

strip.text = element_text(face = "bold", size = 9),

strip.background = element_rect(fill = "gray95", color = "gray80"),

panel.spacing = unit(0.8, "lines")

)

Figure 3: Business Cycles Across Countries

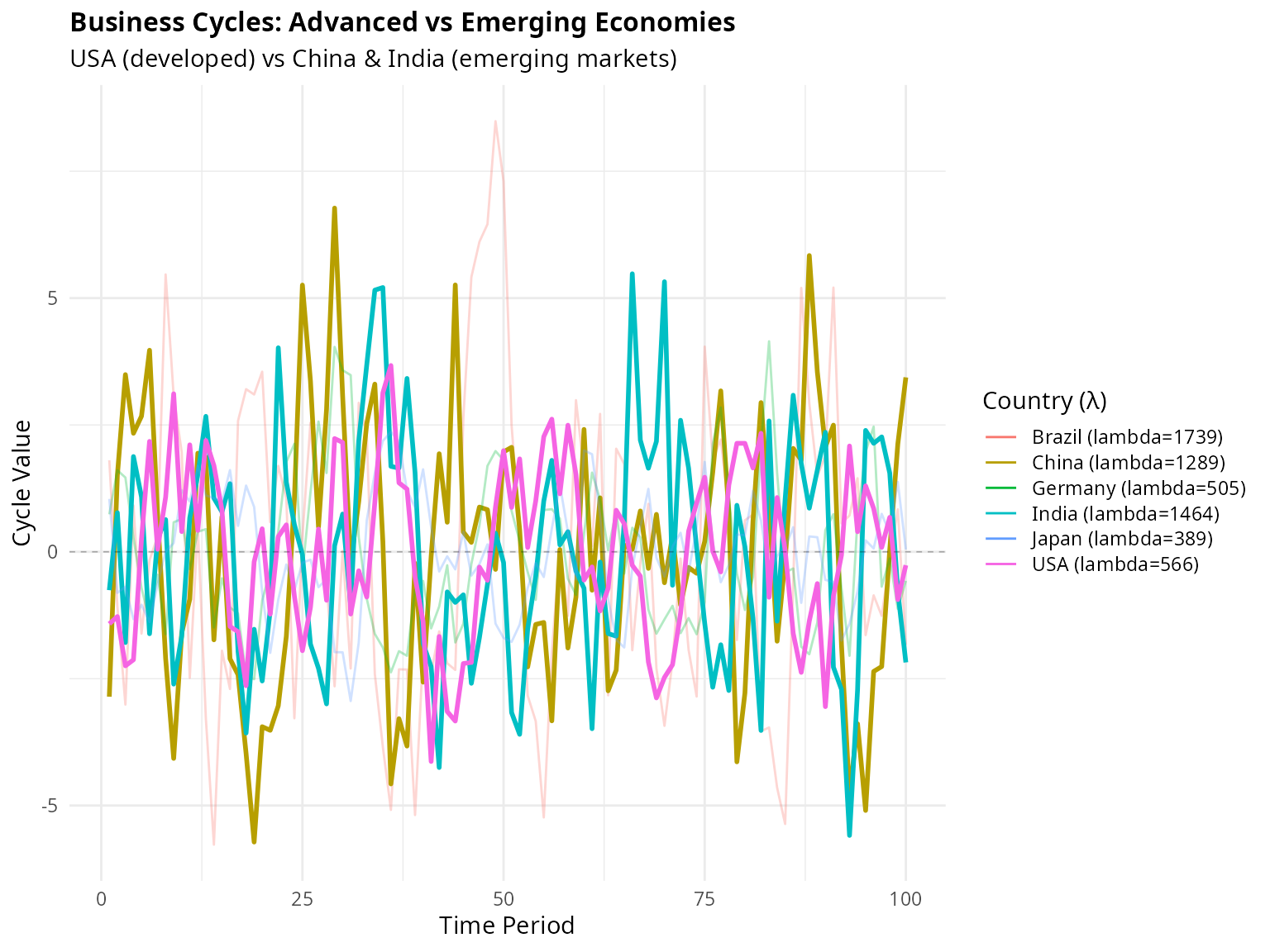

Highlighting Specific Countries

plot_batch(batch_result, show = "cycle", facet = FALSE,

highlight = c("USA", "China", "India")) +

labs(

title = "Business Cycles: Advanced vs Emerging Economies",

subtitle = "USA (developed) vs China & India (emerging markets)",

color = "Country (λ)"

) +

theme_minimal(base_size = 11) +

theme(

plot.title = element_text(face = "bold", size = 12),

legend.position = "right",

legend.key.height = unit(0.8, "lines")

)

Figure 4: Highlighted Comparison

Batch Comparison with Standard HP

comparison <- batch_compare(gdp_data, frequency = "quarterly", max_lambda = 10000)

print(comparison)

#> series hp_lambda mhp_lambda hp_cycle_sd mhp_cycle_sd sd_diff hp_ar1

#> <char> <num> <int> <num> <num> <num> <num>

#> 1: USA 1600 566 1.849002 1.650031 -0.19897143 0.6777133

#> 2: Germany 1600 505 1.728567 1.496906 -0.23166103 0.7346829

#> 3: Japan 1600 389 1.357226 1.099696 -0.25753039 0.7784002

#> 4: China 1600 1289 2.606722 2.568540 -0.03818215 0.5954362

#> 5: Brazil 1600 1739 2.955147 2.967902 0.01275438 0.5726763

#> 6: India 1600 1464 2.258162 2.246082 -0.01207980 0.5016707

#> mhp_ar1 ar1_diff relative_sd

#> <num> <num> <num>

#> 1: 0.6111909 -0.066522391 0.8923898

#> 2: 0.6598704 -0.074812412 0.8659809

#> 3: 0.6723097 -0.106090519 0.8102524

#> 4: 0.5828127 -0.012623423 0.9853524

#> 5: 0.5760828 0.003406520 1.0043160

#> 6: 0.4965493 -0.005121396 0.9946506

# Analyze differences

cat("\nSummary of Lambda Differences:\n")

#>

#> Summary of Lambda Differences:

cat("Mean optimal λ:", round(mean(comparison$lambda), 0), "\n")

#> Mean optimal λ: NA

cat("Fixed λ (HP): 1600\n")

#> Fixed λ (HP): 1600

cat("Range of optimal λ:", paste0("[", min(comparison$lambda), ", ",

max(comparison$lambda), "]"), "\n\n")

#> Range of optimal λ: [Inf, -Inf]

cat("Countries with λ > 2000:",

paste(comparison$series[comparison$lambda > 2000], collapse = ", "), "\n")

#> Countries with λ > 2000:

cat("Countries with λ < 1000:",

paste(comparison$series[comparison$lambda < 1000], collapse = ", "), "\n")

#> Countries with λ < 1000:Example 4: Real Business Cycle Analysis

Demonstrating how the Modified HP filter affects business cycle statistics:

# Focus on one country for detailed analysis

usa_gdp <- gdp_data[, "USA"]

usa_mhp <- mhp_filter(usa_gdp, max_lambda = 10000, as_dt = FALSE)

usa_hp <- hp_filter(usa_gdp, lambda = 1600, as_dt = FALSE)

# Create comparison data.table

bc_stats <- data.table(

Method = c("Modified HP", "Standard HP"),

Lambda = c(usa_mhp$lambda, 1600),

`Mean Cycle` = c(mean(usa_mhp$cycle), mean(usa_hp$cycle)),

`SD Cycle` = c(sd(usa_mhp$cycle), sd(usa_hp$cycle)),

`Min Cycle` = c(min(usa_mhp$cycle), min(usa_hp$cycle)),

`Max Cycle` = c(max(usa_mhp$cycle), max(usa_hp$cycle)),

`AR(1) Coef` = c(

cor(usa_mhp$cycle[-1], usa_mhp$cycle[-length(usa_mhp$cycle)]),

cor(usa_hp$cycle[-1], usa_hp$cycle[-length(usa_hp$cycle)])

)

)

print(bc_stats)

#> Method Lambda Mean Cycle SD Cycle Min Cycle Max Cycle AR(1) Coef

#> <char> <num> <num> <num> <num> <num> <num>

#> 1: Modified HP 566 -6.454571e-13 1.650031 -4.132040 3.671701 0.613421

#> 2: Standard HP 1600 5.820198e-12 1.849002 -4.743509 3.497196 0.683282Cyclical Properties Visualization

# Create data for plotting

plot_data <- data.table(

Time = rep(1:n_time, 2),

Cycle = c(usa_mhp$cycle, usa_hp$cycle),

Method = rep(c("Modified HP", "Standard HP"), each = n_time),

Lambda = rep(c(paste0("λ = ", usa_mhp$lambda), "λ = 1600"), each = n_time)

)

ggplot(plot_data, aes(x = Time, y = Cycle, color = Method, linetype = Method)) +

geom_hline(yintercept = 0, linetype = "dashed", color = "gray60", linewidth = 0.5) +

geom_line(linewidth = 0.8) +

scale_color_manual(values = c("Modified HP" = "#0072B2", "Standard HP" = "#D55E00")) +

scale_linetype_manual(values = c("Modified HP" = "solid", "Standard HP" = "dashed")) +

labs(

title = "Business Cycle Components: Method Comparison",

subtitle = "Modified HP filter allows for data-driven smoothing",

x = "Time Period (Quarters)",

y = "Cyclical Component",

color = NULL,

linetype = NULL

) +

theme_minimal(base_size = 11) +

theme(

plot.title = element_text(face = "bold", size = 12),

legend.position = "bottom",

panel.grid.minor = element_blank()

)

Figure 5: Cyclical Properties Comparison

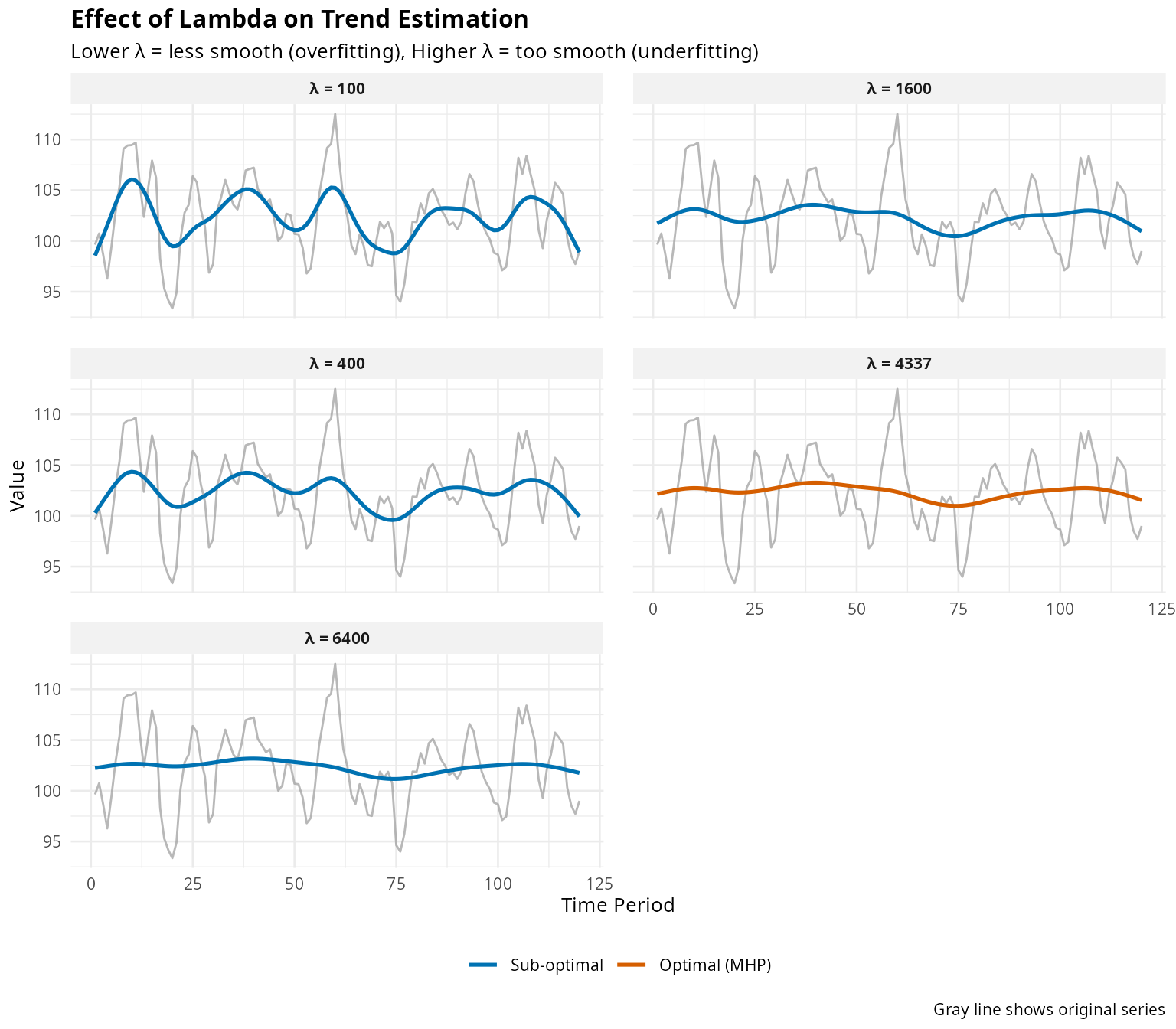

Example 5: Sensitivity to Lambda

Demonstrating why optimal lambda selection matters:

# Try different lambda values

lambdas_to_try <- c(100, 400, 1600, 6400, get_lambda(mhp_res))

lambda_results <- lapply(lambdas_to_try, function(lam) {

res <- hp_filter(gdp, lambda = lam, as_dt = FALSE)

data.table(

Time = 1:length(gdp),

Original = gdp,

Trend = res$trend,

Cycle = res$cycle,

Lambda = paste0("λ = ", lam),

Is_Optimal = lam == get_lambda(mhp_res)

)

})

sens_data <- rbindlist(lambda_results)

# Plot trends

ggplot(sens_data, aes(x = Time)) +

geom_line(aes(y = Original), color = "gray60", linewidth = 0.5, alpha = 0.7) +

geom_line(aes(y = Trend, color = Is_Optimal), linewidth = 0.9) +

facet_wrap(~Lambda, ncol = 2) +

scale_color_manual(values = c("TRUE" = "#D55E00", "FALSE" = "#0072B2"),

labels = c("Sub-optimal", "Optimal (MHP)"),

name = NULL) +

labs(

title = "Effect of Lambda on Trend Estimation",

subtitle = "Lower λ = less smooth (overfitting), Higher λ = too smooth (underfitting)",

x = "Time Period",

y = "Value",

caption = "Gray line shows original series"

) +

theme_minimal(base_size = 10) +

theme(

plot.title = element_text(face = "bold", size = 12),

strip.text = element_text(face = "bold"),

strip.background = element_rect(fill = "gray95", color = NA),

legend.position = "bottom",

panel.spacing = unit(1, "lines")

)

Figure 6: Sensitivity to Lambda Choice

Performance Tips

Choosing max_lambda

The max_lambda parameter determines the search

range:

# For most macroeconomic applications

result_standard <- mhp_filter(gdp, max_lambda = 10000)

cat("Standard search (max_lambda=10000):\n")

#> Standard search (max_lambda=10000):

cat(" Optimal λ:", get_lambda(result_standard), "\n")

#> Optimal λ: 4337

cat(" GCV:", format(get_gcv(result_standard), digits = 4), "\n\n")

#> GCV: 14.36

# For very smooth trends or unusual series

result_extended <- mhp_filter(gdp, max_lambda = 50000)

cat("Extended search (max_lambda=50000):\n")

#> Extended search (max_lambda=50000):

cat(" Optimal λ:", get_lambda(result_extended), "\n")

#> Optimal λ: 4337

cat(" GCV:", format(get_gcv(result_extended), digits = 4), "\n\n")

#> GCV: 14.36

# Check if we're near the boundary

if (get_lambda(result_standard) > 0.95 * 10000) {

cat("WARNING: Optimal λ near upper bound. Consider increasing max_lambda.\n")

}Batch Processing Efficiency

# Efficient for multiple series

large_dataset <- matrix(rnorm(100 * 50), nrow = 100, ncol = 50)

system.time(batch_result <- mhp_batch(large_dataset, max_lambda = 5000))

# Less efficient: loop over columns

system.time({

manual_result <- lapply(1:50, function(i) {

mhp_filter(large_dataset[, i], max_lambda = 5000)

})

})Summary and Recommendations

When to Use Modified HP Filter

✓ Recommended for:

- Cross-country macroeconomic comparisons

- Analysis of different economic variables (GDP, consumption, investment)

- Uncertain about appropriate λ for your context

- Need defensible, data-driven parameter selection

- Comparing business cycles across countries with different volatility

Standard HP may suffice when:

- Replicating published studies using fixed λ

- U.S. quarterly GDP analysis matching original HP (1997) context

- Speed is critical and λ = 1600 is demonstrably appropriate

Key Takeaways

- Optimal λ varies substantially across countries and variables

- Fixed λ may mis-assign variation to trend vs cycle

- Modified HP filter provides data-driven selection via GCV

- Batch processing enables efficient multi-series analysis

- Visualization tools help understand differences between methods

References

Choudhary, M.A., Hanif, M.N., & Iqbal, J. (2014). On smoothing macroeconomic time series using the modified HP filter. Applied Economics, 46(19), 2205-2214. https://doi.org/10.1080/00036846.2014.896982

Hodrick, R.J., & Prescott, E.C. (1997). Postwar US business cycles: An empirical investigation. Journal of Money, Credit and Banking, 29(1), 1-16.

McDermott, C.J. (1997). An automatic method for choosing the smoothing parameter in the HP filter. Unpublished manuscript, International Monetary Fund.

Ravn, M.O., & Uhlig, H. (2002). On adjusting the Hodrick-Prescott filter for the frequency of observations. Review of Economics and Statistics, 84(2), 371-376.

See Also

-

vignette("methodology", package = "mhpfilter")- Detailed mathematical theory -

?mhp_filter- Main filtering function -

?mhp_batch- Batch processing -

?mhp_compare- Comparison tools