Compare HP and Modified HP filters across multiple time series. Useful for panel data analysis and method validation.

Usage

batch_compare(X, frequency = c("quarterly", "annual"), max_lambda = 100000L)Value

A data.table with comparison metrics for each series:

- series

Series identifier

- hp_lambda

Lambda used for HP filter (1600 or 100)

- mhp_lambda

Optimal lambda from Modified HP

- hp_cycle_sd

Cycle standard deviation (HP)

- mhp_cycle_sd

Cycle standard deviation (Modified HP)

- sd_diff

Difference in cycle SD (MHP - HP)

- hp_ar1

Cycle AR(1) coefficient (HP)

- mhp_ar1

Cycle AR(1) coefficient (Modified HP)

- ar1_diff

Difference in AR(1) (MHP - HP)

- relative_sd

mhp_cycle_sd / hp_cycle_sd

Details

For each series in X, this function: 1. Applies standard HP filter with frequency-appropriate lambda 2. Applies Modified HP filter with GCV optimization 3. Calculates comparison statistics on cyclical components

The comparison helps identify: - Series where Modified HP substantially changes cycle properties - Optimal lambdas across different types of series - Relative performance of automatic vs fixed smoothing

References

Choudhary, M.A., Hanif, M.N., & Iqbal, J. (2014). On smoothing macroeconomic time series using the modified HP filter. Applied Economics, 46(19), 2205-2214.

Examples

# Example 1: Country GDP comparison

set.seed(101)

n <- 80

countries <- c("USA", "UK", "Japan", "Germany", "France", "Italy", "Canada", "Australia")

gdp_data <- sapply(countries, function(ctry) {

# Varying volatility and persistence

vol <- runif(1, 0.5, 2.5)

persist <- runif(1, 0.6, 0.95)

trend <- cumsum(rnorm(n, 0.5, 0.3))

cycle <- arima.sim(list(ar = persist), n, sd = vol)

trend + cycle

})

results <- batch_compare(gdp_data, frequency = "quarterly", max_lambda = 10000)

print(results)

#> series hp_lambda mhp_lambda hp_cycle_sd mhp_cycle_sd sd_diff

#> <char> <num> <int> <num> <num> <num>

#> 1: USA 1600 1317 1.4234427 1.4087969 -0.014645761

#> 2: UK 1600 6923 2.2501287 2.3141371 0.064008449

#> 3: Japan 1600 811 0.8679768 0.8203508 -0.047626003

#> 4: Germany 1600 688 0.7904605 0.7248391 -0.065621379

#> 5: France 1600 1702 2.5930919 2.6000972 0.007005289

#> 6: Italy 1600 637 2.9063951 2.6832130 -0.223182177

#> 7: Canada 1600 2408 1.2925740 1.3098183 0.017244216

#> 8: Australia 1600 1368 2.3354516 2.3167453 -0.018706327

#> hp_ar1 mhp_ar1 ar1_diff relative_sd

#> <num> <num> <num> <num>

#> 1: 0.4634548 0.4536856 -0.009769214 0.9897110

#> 2: 0.4198404 0.4488474 0.029006967 1.0284466

#> 3: 0.6439636 0.6064673 -0.037496385 0.9451299

#> 4: 0.5337024 0.4488174 -0.084884984 0.9169834

#> 5: 0.5734333 0.5755733 0.002140053 1.0027015

#> 6: 0.6713875 0.6145662 -0.056821328 0.9232100

#> 7: 0.4037357 0.4199658 0.016230111 1.0133410

#> 8: 0.3748145 0.3661056 -0.008708860 0.9919903

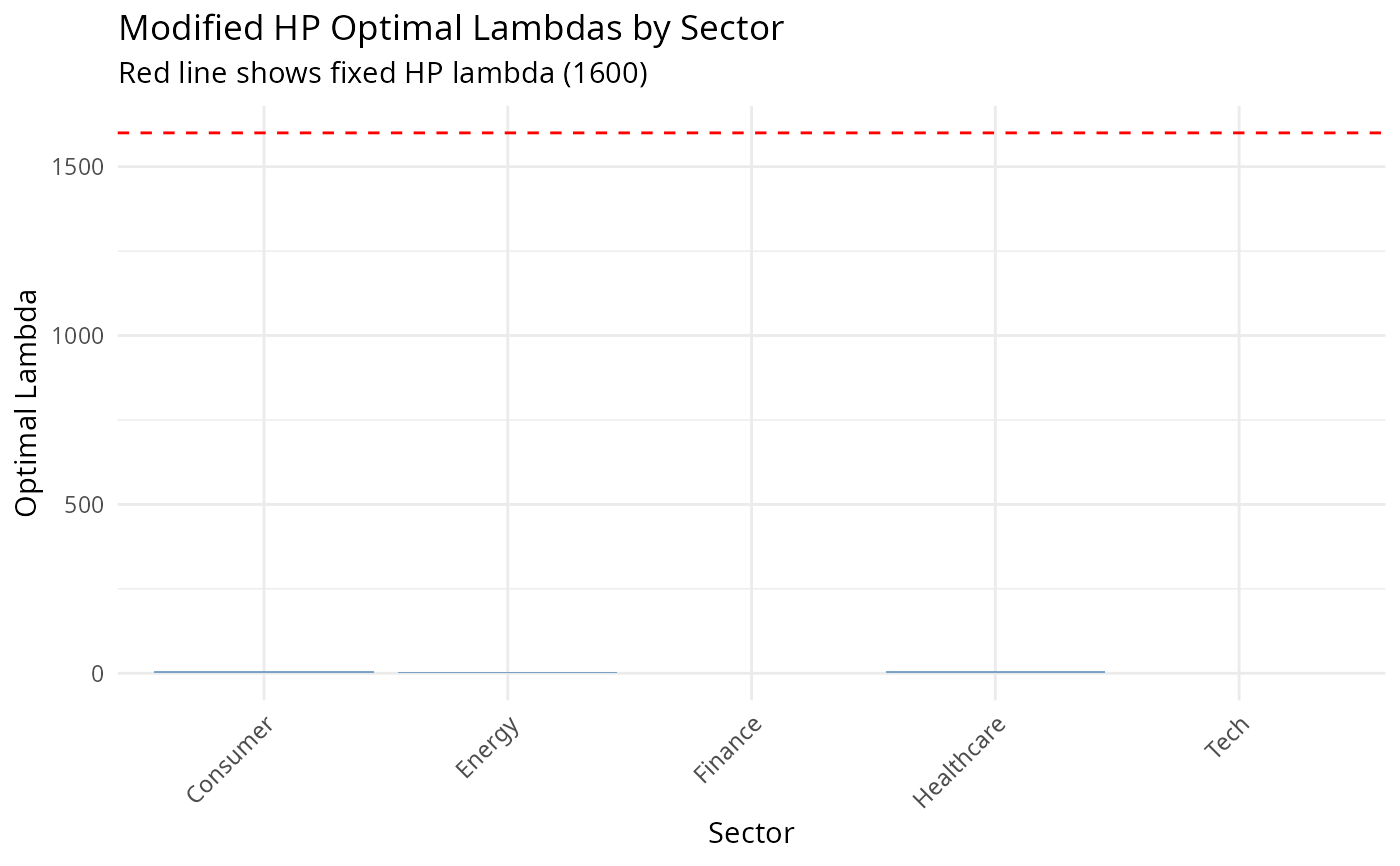

# Example 2: Sectoral analysis with visualization

set.seed(2024)

n_time <- 100

sectors <- c("Tech", "Finance", "Energy", "Healthcare", "Consumer")

sector_returns <- matrix(rnorm(n_time * length(sectors)), nrow = n_time)

# Add sector-specific characteristics

for (i in 1:length(sectors)) {

drift <- runif(1, -0.1, 0.3)

volatility <- runif(1, 0.5, 2.0)

sector_returns[, i] <- cumsum(rnorm(n_time, mean = drift / 100, sd = volatility / 100)) +

runif(1, 0.5, 2) * sin(2 * pi * (1:n_time) / (20 + i * 3))

}

colnames(sector_returns) <- sectors

sector_comparison <- batch_compare(sector_returns, frequency = "quarterly", max_lambda = 5000)

if (require(ggplot2)) {

# Plot lambda comparison

lambda_plot <- ggplot2::ggplot(

sector_comparison,

ggplot2::aes(x = series, y = mhp_lambda)

) +

ggplot2::geom_col(fill = "steelblue", alpha = 0.7) +

ggplot2::geom_hline(yintercept = 1600, linetype = "dashed", color = "red") +

ggplot2::labs(

title = "Modified HP Optimal Lambdas by Sector",

subtitle = "Red line shows fixed HP lambda (1600)",

x = "Sector", y = "Optimal Lambda"

) +

ggplot2::theme_minimal() +

ggplot2::theme(axis.text.x = ggplot2::element_text(angle = 45, hjust = 1))

print(lambda_plot)

}